Paysend Review

Table of contents

TogglePaysend promo code: benefits

Paysend’s cost is a consequent reason for using it. It doesn’t matter how much you send, the company only charges a flat fee of $1.99 for each transaction. This makes it an interesting option for those who send either little or large amounts of money. What’s more, you can increase the savings on your offers by using Top Parrainage’s offer, in partnership with Paysend: the Paysend promo code.

Paysend’s accessibility to a wide range of countries is another advantage. You can use Paysend to send money wherever you want, no matter where you’re sending it from: the US, Canada, the UK or anywhere else. It’s a good option if you look for sending money to friends and family abroad, as well as businesses that need to make payments overseas.

Paysend also offers a variety of payment methods, such as bank transfers, credit cards, debit cards and e-wallets. This makes it easy to find the best payment method and transfer money quickly and easily. When you open an account with Paysend and make your first transaction, you can enjoy even more benefits with our Paysend promo code.

What’s more, Paysend is a highly secured service using encryption technology to protect your personal financial information. You can be sure that Paysend keeps your money safe. Also, you can be sure to get the best deals when you use our Paysend promo code.

Paysend is, all things considered, a fantastic choice for anyone looking to send money abroad. It’s a great choice for everyone because of its affordability, worldwide availability, payment options and security. You can also use special discount codes to get even more benefits when you sign up to Paysend. Visit the Paysend website, sign up using your Paysend promo code and start sending money abroad for less right away.

Paysend Opinion and Discount code

Paysend is a digital money transfer service that allows users to send money abroad at a reasonable cost. More than 90 countries are now served by the company since its inception in 2012. We’ll look at Paysend in more detail in this article, including exchange rates, costs, the most popular locations you can send money to, the pros and cons of using the service and the different types of transfer available. How long does it take to get money via Paysend?

Regarding Paysend

Paysend is a digital money transfer service that makes sending money abroad affordable for individuals and businesses. The company uses cutting-edge technology to provide a simple, fast and secure service. Paysend supports over 50 currencies and operates in over 90 countries.

Exchange rates, fees and expenses: Paysend Review

Paysend is a global money transfer service that offers users affordable fees and competitive exchange rates to send money to over 80 countries.

The exchange rate is one of Paysend’s key features. The company often guarantees lower rates than conventional banks and other money transfer services. The currency you send money in, the country it’s going to and the amount you send will all affect the exchange rate you receive. Paysend says that bank rates, which are the prices at which currencies are bought and sold between banks, are generally within 1% of the median rate. You can set alerts for particular exchange rates using the ‘Rate Alerts’ function that Paysend also provides. This allows you to get interesting exchange rates when they appear.

Paysend is frequently cited as one of the cheapest options in terms of fees. The company charges a flat fee for each transaction. Depending on the country, this generally ranges from $1 to $5. There are no additional fees and users can see the total cost of the transfer before proceeding.Le faible montant minimum de transfert de Paysend est un autre élément qui attire de nombreux utilisateurs vers le service. Il est simple d’envoyer de petits montants à des amis et à la famille ou de faire des achats en ligne rapides lorsque les utilisateurs peuvent envoyer de l’argent à partir de seulement 1 $.

In general, Paysend is a cheap and user-friendly option for users who wish to send money abroad. Paysend is the best option for anyone who is looking to send money, as the exchange rates are competitive, with low fees and low minimum transfer amounts.

Main locations for sending money with Paysend.

Les utilisateurs de Paysend peuvent envoyer de l’argent à divers endroits, ce qui est l’un de ses avantages. Les principaux emplacements vers lesquels de l’argent peut être envoyé à l’aide de Paysend sont les suivants :

- United States:

Users can send money using Paysend to US mobile wallets or bank accounts. It’s a popular place for people to make online purchases from US merchants or send money to friends and family. - England:

Paysend users can also send money to UK bank accounts. It’s a popular place for people to shop online with UK merchants or send money to friends and family. - Philippines :.

For those wanting to send money to the Philippines, Paysend is a fantastic option. Users are able to send money to domestic bank accounts and mobile wallets, giving recipients quick access to their money. - India:

Paysend users can also send money to Indian bank accounts. It’s a popular place to shop online and send money to friends and family. - Spain:

Paysend users can transfer funds to Spanish bank accounts. Sending money to friends and family, as well as making online purchases, are very common in Spain. - Russia:

Users can also send money to Russian bank accounts using Paysend. When people want to send money to friends and family, Russia is a common choice.

Some of the many locations supported by the Paysend promo code are listed above. Users can also send money to many other countries, including China, Australia, Canada and Mexico. What’s more, Paysend supports a variety of currencies. This means that users can send money for free in their own currency and recipients can receive it for free in their own currency.

Advantages and disadvantages of using: Paysend Review

- Competitive exchange rates:

Paysend often offers better exchange rates than conventional banks and other money transfer services. The company promises to provide rates of less than 1% of the average rate, which is the price at which currencies are typically bought and sold between banks. - Low cost:

Paysend charges a fixed fee for each transaction. This varies from country to country, but is generally between $1 and $5. There are no additional fees and users can see the total cost of the transfer before proceeding. - Child’s play to use:

The Paysend platform is simple to use and User-friendly.Users can quickly and easily shop online. They can also send money to friends and family. - A number of currencies:

Paysend accepts a variety of currencies. Users can send money using their local currency at no extra cost, and recipients can receive money using their own currency.

Price warning :

Paysend users can also set alerts for particular exchange rates using a feature called ‘Rate Alerts’. This allows users to benefit from advantageous exchange rates when they appear.

- Country restrictions apply to availability:

Users may not be able to send money to all destinations as Paysend is currently only available in 80 countries.

fewer payment methods. Some users may find Paysend’s current support for bank transfers a disadvantage. - Larger transfers are subject to higher fees:

Paysend’s high percentage of fees in its fixed charges may make it less economical for larger transfers. - Not all currencies are accepted:

Although not all currencies are supported by Paysend, many are. Therefore, users may not be able to send money in certain currencies to certain destinations. - There is no option to withdraw money:

Paysend only accepts bank transfers at the moment. Users cannot send money to cash withdrawal points; instead, they can only send it to bank accounts and mobile wallets.

What types of transfers are handled by: Paysend Review?

The variety of money transfer options Paysend offers its users is one of its main features.

- Payment:

Paysend users can transfer money directly to the recipient’s bank account. A common choice for those wishing to send money to friends and family or make online purchases. - Smartphone wallet:

Paysend users also have the option of sending money directly to the recipient’s mobile wallet. a popular choice for those looking to send money to countries with few bank accounts. - Card-to-card transfers:

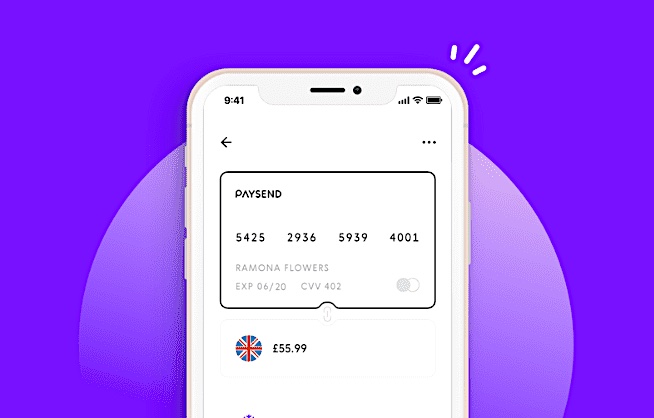

Money transfers from one card to another are also possible with Paysend. A popular choice for people looking to make online purchases or send money to friends and family. - Digital card:

Users can create virtual cards that are connected to their Paysend accounts using the virtual card feature that Paysend also provides. For those who want more security in their transactions, this virtual card is an excellent option and can be used for online purchases. - Crypto-currency :

Paysend users can also buy and sell crypto-currencies such as Bitcoin Cash, Ethereum, Litecoin and Bitcoin. Paysend is a fantastic choice for those who want to use crypto-currencies as a payment method thanks to this feature. - Full payment:

In addition, Paysend provides a bulk payment feature that allows business users to send payments to multiple recipients at once. Businesses that need to process multiple payments at once should use this feature. B. payments made to partners, suppliers or employees. - API integration :

Businesses can integrate Paysend’s service into their existing systems for simpler payment management through the API integrations Paysend also provides.

How quickly can you receive money using: Paysend Review?

With competitive exchange rates, low fees and an intuitive platform, Paysend is a global money transfer service that allows users to send money to over 80 countries worldwide. The time it takes for a money transfer to reach the recipient is one of the crucial factors to consider when using money transfer services. Many factors influence the duration of the transfer.

The destination and the transfer method are two factors that affect Paysend’s delivery times. In general, bank transfers take longer than transfers to a mobile wallet. The delivery time is also influenced by the processing time of the receiving bank and the destination country.

Approximate delivery times to some of our most popular locations are shown below:.

U.S:

1 to 2 open days.

France:

1 to 2 open days.

England:.

1 to 2 open days.

Philippines :.

2 to 3 open days.

India:.

3 to 2 open days.

Spain:.

1 to2 open days.

Russia:.

2 to 3 open days.

These are approximate estimates, and actual delivery times may differ due to factors such as the speed with which banks process payments on certain days of the year. In addition, Paysend offers an express option that allows recipients to receive their money in as little as 30 minutes to a few specific destinations. However, this option may come with an additional cost.

Please note that Paysend will send two emails: one after the transfer has been completed and one after the money has been credited to the recipient’s account. Before considering the transfer completed, it is advisable to ensure that the recipient has received the funds.

In conclusion, Paysend is a global money transfer service with competitive exchange rates, low fees and an intuitive platform that allows users to send money to over 80 countries worldwide. What’s more, the Paysend promo code is an opportunity to jump in head first! The time it takes to send money varies depending on the recipient, the transfer method and the time the bank needs to process the transaction, but it usually takes 1-3 buses.

What are the best reasons to use: Paysend Review?

Here are some of the best reasons to use Paysend, and even more so with our paysend promo code if you are sending money internationally.

- Competitive exchange rates:

Paysend guarantees to offer exchange rates that are within 1% of the average rate, which represents the price at which currencies are generally bought and sold between banks. As a result, users will not overpay for their services, but can expect to pay a fair price for their transfers. With the paysend promo code, take advantage of a reduced exchange rate of -0.07%. - Low cost:

Each transaction with Paysend has a fixed fee. differs by country, but is generally between $1 and $5. Users can see the exact transfer cost before making the transfer, and there are no additional fees of any kind. - Child’s play to use:

Paysend’s platform is user-friendly and simple to use. Customers can shop online quickly and easily. They can also send money to friends and family. - A number of currencies:

Paysend supports several currencies. Users can send money in their local currency and recipients can receive it for free in their own currency. Price alerts :

Users can set alerts for particular exchange rates using the ‘Rate Alerts’ function that Paysend also provides. Users can benefit from advantageous exchange rates when they appear accordingly.A wide variety of transfer options:

For those looking to transfer money internationally, Paysend offers a variety of money transfer options. Paysend can help you buy or sell crypto-currencies as well as send money to bank accounts, mobile wallets, virtual cards and more.24-hour support:

Paysend provides 24-hour phone, email and live chat support so users can get help when and where they need it.Overall, Paysend is a fantastic choice for anyone looking to send money abroad. Paysend is the best place to send money because of its affordable fees, multiple currencies, rate alerts, easy-to-use platform, bulk payments capability, API integration and 24-hour customer service. perfectly suited for everyone. With the paysend promo code, all you have to do is make the most of it!

Discover our other offers like Babbel, Blackbull Markets ou Hostinger